|

This post may contain affiliate links. Please read my disclaimer for more info.

Today, you’ll learn about getting started with cashflow planning with Float.

6 out of 10 businesses fail in 5 years or less according to Ormsby Street, via the Office for National Statistics. Poor cashflow is often cited as the main reason for business failure.

Understanding how cash moves through your business is therefore of vital importance to your success.

It’s actually easier to get started than you think. Using a tool like Float means that the hard work is done for you as it pulls your company financial information directly from Xero, Quickbooks online or FreeAgent.

Click here to start your 14 day trial, then use the tutorial below for easy directions on how to set up your account.

You may be thinking, “I can plan my cash flow with a spreadsheet, I don’t need fancy tools..“

..but ask yourself, how much time are you spending manually updating your spreadsheets? How do you keep your budgets up to date? How do you plan out different scenarios, for example, taking on a new member of staff?

Try out Float’s free trial and see what you think after 2 weeks. No credit card required, just click on the link to get started and sync with your accounting software.

There are many reasons for why you may want to choose Float for your cash flow planning. These reasons include:

1. Click here to sign up for your 14 day trial

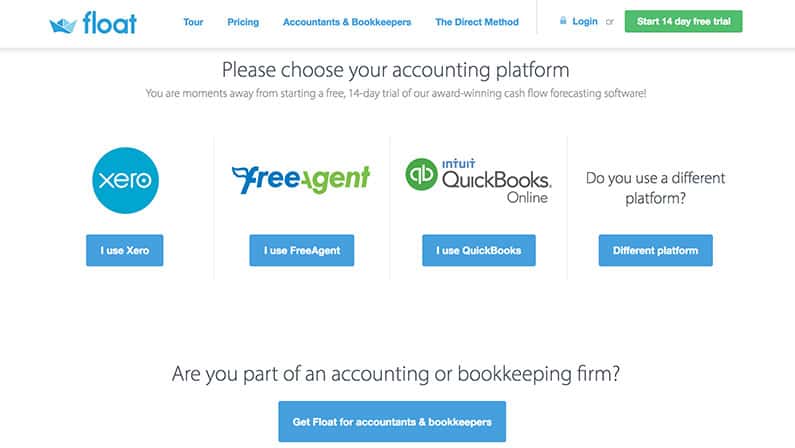

2. Choose your accounting platform (you need to already be using Xero, FreeAgent or Quickbooks Online)

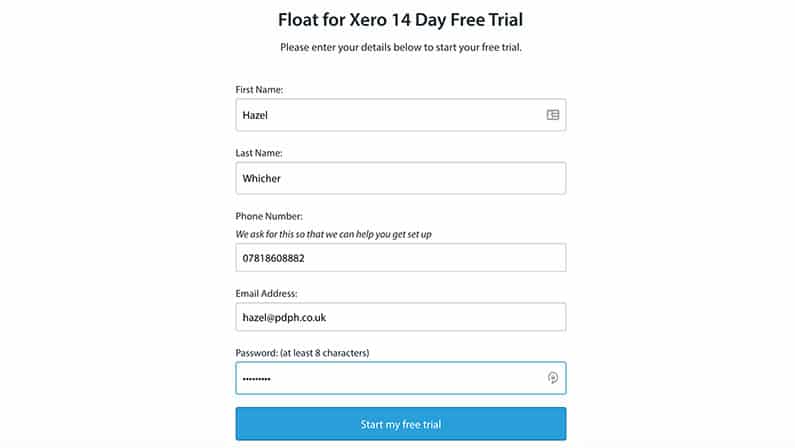

3. Enter your name, phone number, email address and a password

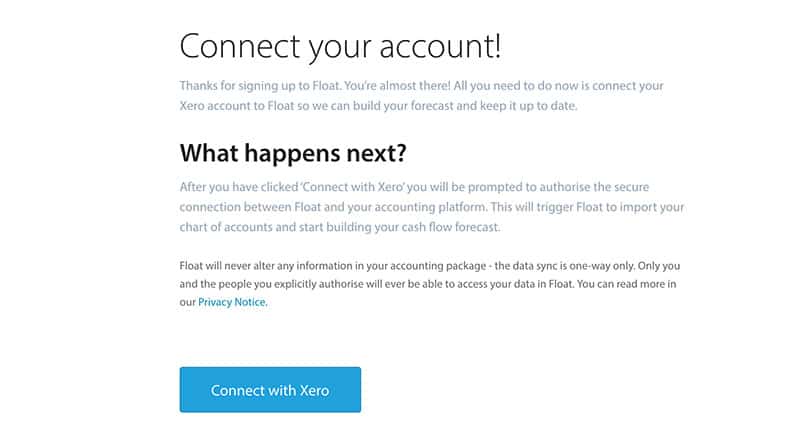

4. Connect your accounting package – in this example, I’m using xero as that’s what I use for our plumbing business

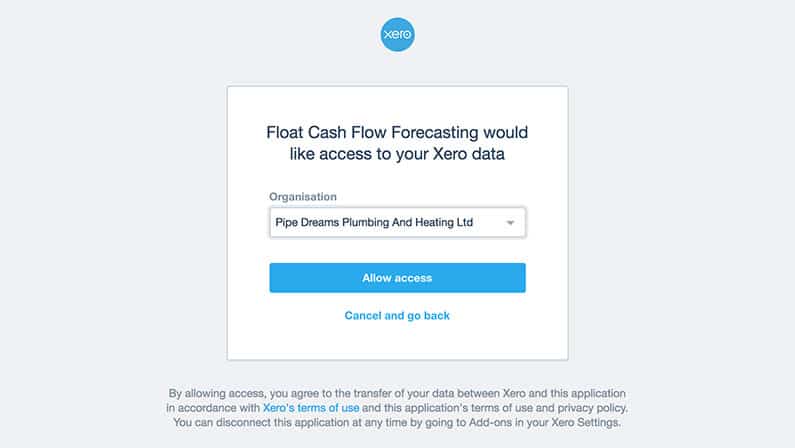

5. Select your account from the dropdown

6. Congratulations! You’ve now successfully set up your float account and connected it with your accounting package!

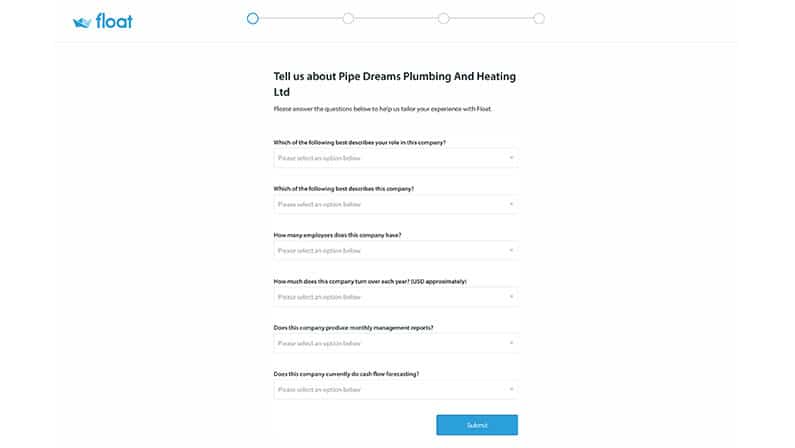

7. Float will now take a few minutes to import your information. While it’s getting your data will ask you a few questions about your business – this will help to tailor your experience.

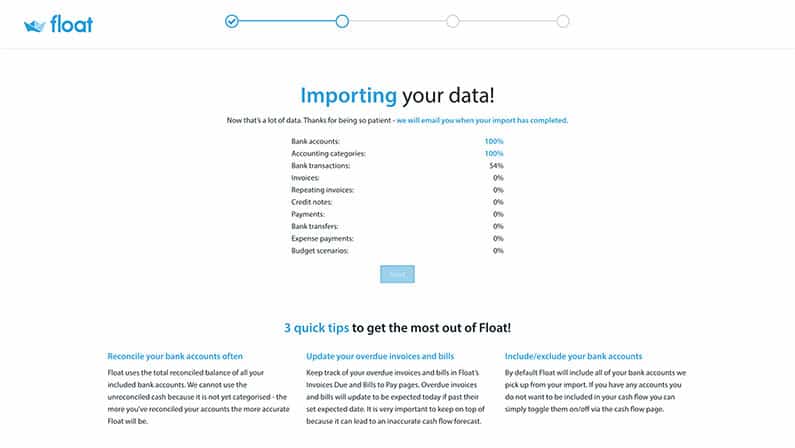

8. You’ll be taken to the import page – float has to grab all of your xero information before it can start providing you with insights.

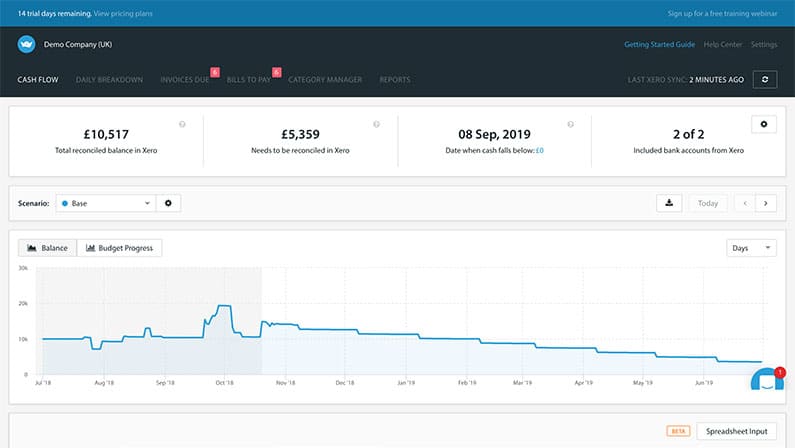

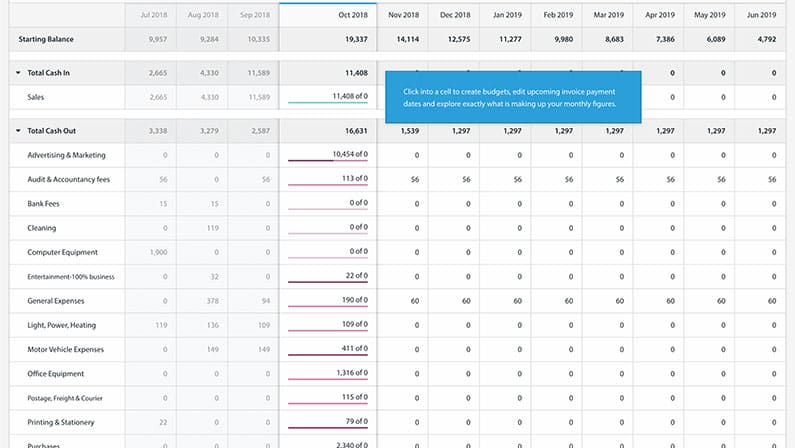

Once the data import is complete, hit the next button and you’ll be taken to your cash flow overview

Here are more cash flow-related posts you should take a look at after you setup your Float account:

Cash flow blog posts from the Float blog

10 steps to cashflow heaven – tips from The Guardian

10 Tips for Better Managing Cash Flow – tips from Quickbooks

Hi, I’m Hazel. I’m a Business Systems Specialist + ServiceM8 Gold Partner.

I can help you craft a business that’s easy and efficient to run.

I ran a plumbing and heating company for 10 years and in 2016 became a ServiceM8 Partner.

I’ve worked with hundreds of business owners just like you to implement easier and more efficient ways of running their business.

My mission is simple: to inspire you and help you develop an efficient and profitable business that gives you the time to do more of what you love.