|

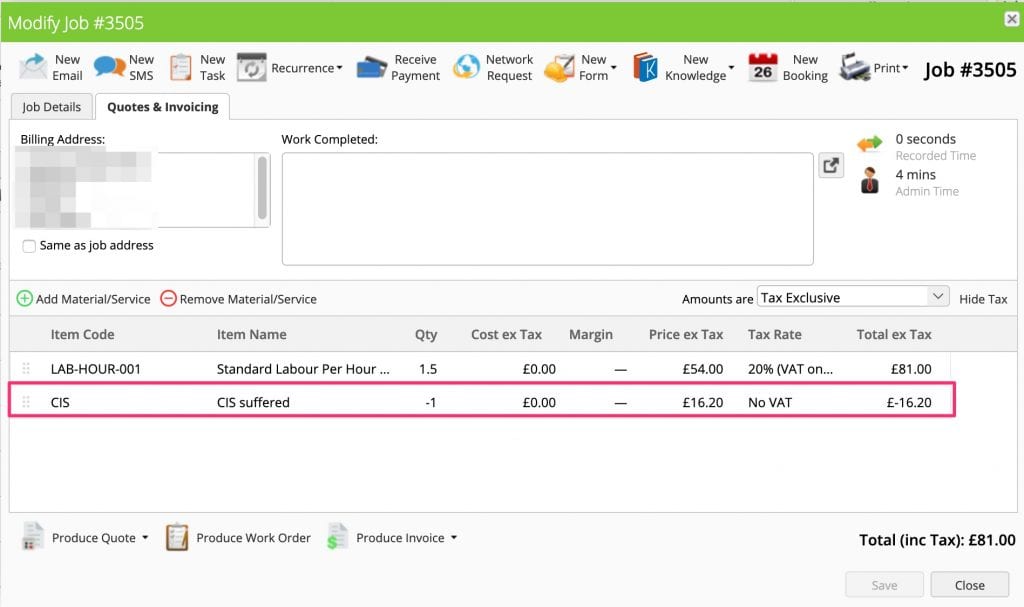

– Open the job you want to deduct CIS from

– Create a CIS suffered item by typing ‘CIS’ in Item Code and CIS Suffered in Item Name

– Add -1 in quantity

– Add the amount you want to remove from the invoice

– Set Tax rate to No VAT

Use this online calculator from V.G. Woodhouse & Co. to work out the deductible CIS

Please note: Check this with your accountant to make sure they’re happy with this method. I take no responsibility for your accounts or CIS process.

Hi, I’m Hazel. I’m a Business Systems Specialist + ServiceM8 Gold Partner.

I can help you craft a business that’s easy and efficient to run.

I ran a plumbing and heating company for 10 years and in 2016 became a ServiceM8 Partner.

I’ve worked with hundreds of business owners just like you to implement easier and more efficient ways of running their business.

My mission is simple: to inspire you and help you develop an efficient and profitable business that gives you the time to do more of what you love.

2 Responses

If accountant is not happy with this method as CIS is not a tax, expects another column in addition to the VAT, can this be done?

Not with ServiceM8 – at that point you’re probably better approving as is from ServiceM8 to your accounting package and then making the invoice look as you want it to in your accounting package.